Weekly marketing wisdom you can read in 5 minutes, for free. Add remarkable ideas and insights to your inbox, once a week, by subscribing to our newsletter.

What Is Customer Acquisition Cost and How to Lower It

Understanding how much it costs to bring a new customer on board is fundamental to business growth. That figure has a name: Customer Acquisition Cost (CAC). In simple terms, it's the total investment required to convince a prospect to buy your product or service.

Think of it as a critical health check for your marketing and sales operations.

What Is Customer Acquisition Cost and Why It Matters

Defining your CAC is not just an accounting exercise; it is the bedrock of a commercially sound growth strategy. Without a clear understanding of this number, you are effectively flying blind, with no reliable way of knowing if your marketing budget is delivering a profitable return.

Knowing your CAC empowers you to make sharp, informed decisions about your budget, which channels deliver genuine value, and how scalable your business model truly is.

For example, if you spend £100 to land a customer who only ever spends £50 with you, your business model has a serious flaw. Conversely, if you know that every £100 invested brings in a customer worth £500, you can pursue growth with strategic confidence.

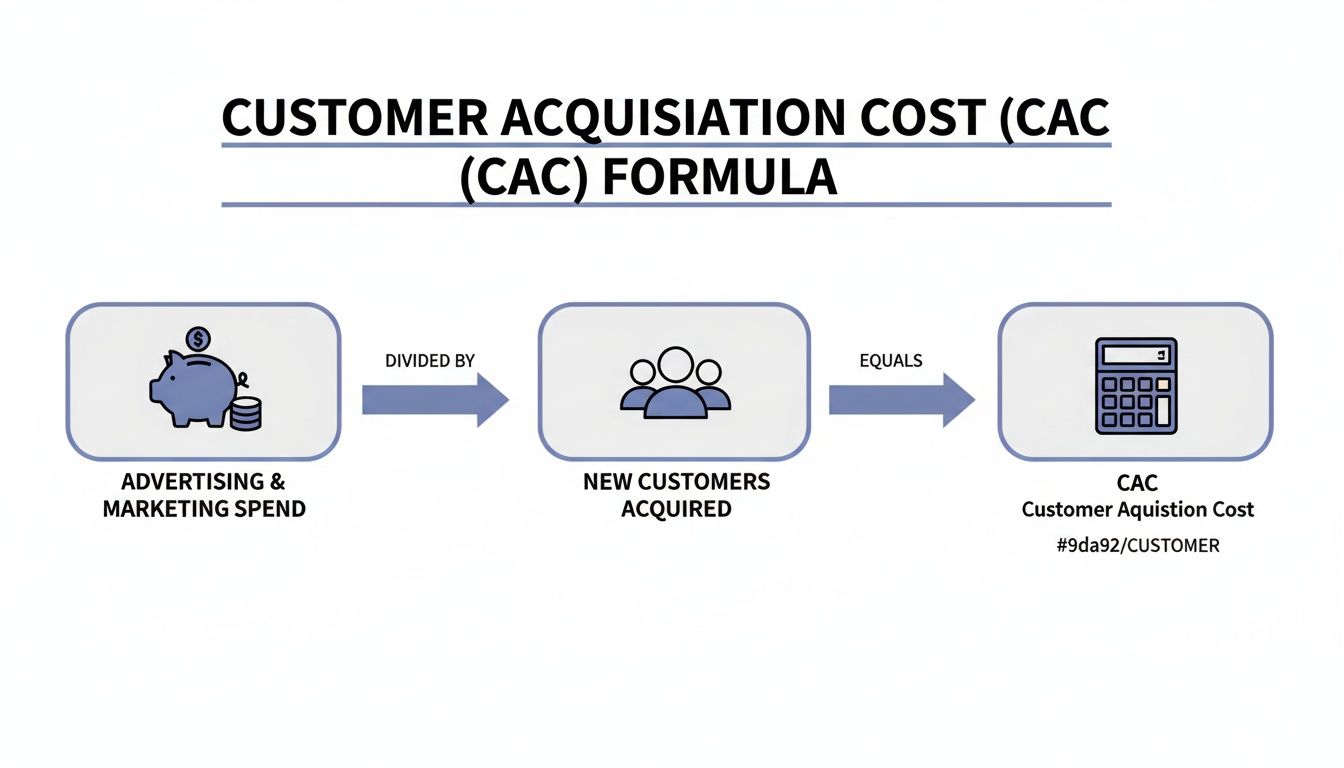

The Basic Formula for CAC

At its core, the calculation is straightforward. Divide your total sales and marketing costs over a defined period by the number of new customers acquired in that same timeframe.

CAC = (Total Sales Costs + Total Marketing Costs) ÷ Number of New Customers Acquired

This simple formula provides a high-level snapshot of your operational efficiency. It answers the fundamental question: how much does it cost us, on average, to win one new paying customer? This clarity is the first step toward building a predictable and profitable lead generation engine.

What to Include in a Fully-Loaded CAC

For this metric to be genuinely useful, it must be comprehensive. A common mistake is to only count direct ad spend, such as the budget for a Google Ads campaign. This approach provides an incomplete and dangerously optimistic view of your real costs.

A "fully-loaded" CAC includes every penny related to winning new business. This ensures your calculations reflect the true commercial reality of your operations.

To get an accurate number, you must account for all related expenses. Below is a breakdown of the typical costs UK businesses should factor into their calculations.

Components of an Accurate CAC Calculation

| Expense Category | Examples for UK Businesses |

|---|---|

| Salaries & Wages | Gross salaries for your sales and marketing team members, including commissions and bonuses. |

| Advertising Spend | Costs for paid media channels like Google Ads, Meta Ads, LinkedIn Ads, or other platforms. |

| Agency & Freelancer Fees | Payments to external partners, such as a digital marketing agency or freelance copywriter. |

| Software & Tools | Subscriptions for your CRM, marketing automation platforms, analytics tools, and SEO software. |

| Content & Creative | Costs associated with producing content, design work, video production, or photography. |

| Sales Overheads | Specific, attributable overheads like travel expenses for sales meetings or client entertainment. |

By including everything from salaries to software subscriptions, you derive a number that tells the true story, helping you make far smarter commercial decisions.

A Practical Guide To Calculating Your CAC

Putting theory into practice is where strategy meets reality. Understanding your Customer Acquisition Cost (CAC) reveals exactly how much it costs to win a new customer and where you might be overspending. The calculation itself is simple, but the insights it generates can reshape your entire growth plan.

CAC Formula:

Total Sales & Marketing Spend ÷ Number of New Customers

Start by selecting a consistent timeframe. A quarter often provides the right balance: long enough to smooth out one-off fluctuations, yet short enough to enable timely strategic adjustments.

Gathering Your Total Costs

This step involves creating a complete picture of every penny spent on acquiring new business. Many businesses fall into the trap of counting only ad budgets, overlooking hidden costs that erode their margins. For a truly “loaded” CAC, you must include:

- Team Salaries: Gross pay, commissions, and bonuses for all sales and marketing personnel.

- Ad Spend: Paid campaigns on Google Ads, Meta Ads, LinkedIn, and other platforms.

- External Fees: Agency retainers, freelance copywriters, or design contractors.

- Tools & Software: CRM subscriptions, email platforms, SEO suites, and other licences.

- Content & Creative: Video production, graphic design, or content writing costs.

Omitting any of these categories will result in an artificially low CAC and could lead to budget shortfalls down the line.

A Worked Example For A B2B Service Firm

Let’s walk through a real-world scenario. Imagine a UK consultancy calculating its expenses for Q3:

- Google Ads Spend: £6,000

- LinkedIn Ads Spend: £3,000

- Marketing Manager Salary (Q3 portion): £12,000

- Salesperson Commission (Q3): £4,000

- SEO Agency Fee (Q3): £4,500

- CRM & Software Subscriptions (Q3): £500

Total Sales & Marketing Spend = £30,000

During that period, the firm secured 60 new clients. Applying these figures to our formula:

CAC = £30,000 ÷ 60 = £500

On average, each new client cost the consultancy £500 to acquire. This single number becomes a critical benchmark, guiding budget decisions, channel investments, and pricing reviews.

A Second Example For A Local Trades Business

The same principles apply to a smaller business. Consider a local plumbing company tracking its costs over six months:

- SEO Agency Retainer: £4,500

- Website Hosting & Maintenance: £300

- Local Blog Content: £600

- Local Services Ads Spend: £1,000

Total Sales & Marketing Spend = £6,400

They attribute 80 new jobs to these marketing efforts. This means:

CAC = £6,400 ÷ 80 = £80

Spending £80 to land a customer is commercially viable if the average job value is £400. Armed with this clarity, the owner can confidently increase investment in SEO or explore other growth channels, knowing the return on every pound spent.

Understanding The Metrics That Give CAC Context

Calculating your Customer Acquisition Cost is an essential first step, but the number is just data on its own. Without context, it is impossible to know if a CAC of £50 is a triumph or a commercial disaster. To turn this single data point into a useful decision-making tool, you need to analyse it alongside other key performance indicators.

These related metrics reveal the true health of your customer acquisition strategy. They tell you whether your marketing spend is fuelling profitable growth or simply burning cash. Once you understand the relationship between these figures, you can move from simply tracking costs to making informed choices that drive sustainable revenue.

This visual breaks down the simple but powerful relationship between your investment and the new customers you acquire, which determines your final CAC.

As you can see, the basic concept is straightforward: combine all your sales and marketing costs, then divide by the number of new customers you won. The result is your cost to acquire a single customer.

Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) is arguably the most important metric to pair with your CAC. It represents the total net profit you can expect to generate from a customer over their entire relationship with your business.

Think of it this way: CAC is the upfront investment, and LTV is the long-term return. A customer who costs £100 to acquire but generates £1,000 in profit over three years is incredibly valuable. In contrast, a customer who costs the same £100 but only ever makes one £75 purchase represents a net loss.

LTV shifts your focus from one-off transactions to long-term value. This helps you identify and attract your most profitable customer segments. For a deeper dive into how this fits into your wider commercial picture, you can learn more about what ROI is in marketing and how it all connects.

The LTV to CAC Ratio

The dynamic between these two metrics is perfectly captured in the LTV to CAC ratio. This simple calculation is a powerful health check for your business model and marketing efficiency.

LTV to CAC Ratio = Customer Lifetime Value ÷ Customer Acquisition Cost

This ratio tells you how many pounds in value you receive for every pound you spend on acquiring a new customer. It’s a clear, at-a-glance indicator of whether your growth engine is running sustainably.

So, what does a good ratio look like?

- 1:1 Ratio: You are losing money. For every customer you acquire, you are only breaking even on the acquisition cost, without covering your operational expenses.

- Less than 3:1 Ratio: Profitability is marginal. There is little room for error, and your business may struggle to scale or absorb unexpected costs.

- 3:1 Ratio: This is widely considered the gold standard. It signals a healthy, sustainable business model where your marketing investment is generating significant returns.

- 4:1+ Ratio: You have a highly efficient growth model. A ratio this high might even suggest you are under-investing in marketing and could grow faster by increasing your spend.

Monitoring this ratio allows you to adjust your strategy with confidence. If it dips too low, you know you either need to reduce your CAC or find ways to increase the value of each customer.

CAC Payback Period

Another critical metric to track is the CAC Payback Period. This tells you exactly how many months it takes for your business to earn back the money invested to acquire a new customer. A shorter payback period means healthier cash flow and a more scalable business.

The calculation is straightforward:

CAC Payback Period (in months) = CAC ÷ (Average Revenue Per Account x Gross Margin %)

Let’s say your CAC is £600. Your average customer pays £100 per month, and your gross margin is 80%. This means you earn £80 in gross profit from that customer each month.

- Payback Period = £600 ÷ £80 = 7.5 months

In this scenario, it will take seven and a half months to recoup your initial acquisition cost. After that point, all revenue from that customer is profit. Most businesses, especially SMEs, aim for a payback period of under 12 months to maintain healthy cash flow and fund growth without requiring external investment. Understanding this timeline is crucial for financial planning and setting realistic targets.

How Your CAC Compares to UK Industry Benchmarks

So, you have calculated your Customer Acquisition Cost. The next logical question is, "Is my CAC good?"

The honest answer is: it depends. A £200 CAC could be a major success for a B2B firm selling high-value software, but it might bankrupt a small ecommerce business. Context is everything, which is why comparing your numbers against UK industry benchmarks is a strategic necessity.

Without this context, your CAC is just a number in isolation. Knowing what is typical for your sector helps you set realistic targets, identify areas for improvement, and make smarter decisions on budget allocation. It provides the yardstick needed to measure how efficiently your marketing is performing against the competition.

Why Does CAC Vary So Much Between Industries?

Not all customers, or markets, are created equal. You will see significant differences in CAC across UK sectors, which usually comes down to a few key factors.

- Average Order Value and LTV: Businesses with large one-off sales (like bespoke machinery) or long-term subscriptions (such as SaaS) can afford to spend more to acquire a customer. The potential lifetime value justifies a larger upfront marketing investment.

- Sales Cycle Length: A complex B2B sale that takes six months of meetings and demonstrations will naturally have a higher CAC than a quick online purchase. You are paying not just for ads, but for your sales team's time and effort over that entire period.

- Market Competition: In a crowded space like fashion or consumer electronics, advertising costs are significantly higher. Intense competition for the same audience drives up bidding prices and inflates CAC for everyone.

- Customer Trust and Perceived Risk: It takes far more persuasion to sell a £50,000 piece of equipment than a £50 pair of shoes. This requires in-depth content, consultations, and substantial trust-building, all of which add to the cost of acquisition.

Understanding these factors is crucial for evaluating your own performance. The goal is not simply to achieve the lowest possible CAC, but to have an efficient CAC relative to the value each new customer delivers.

UK Ecommerce and Service Benchmarks

To put this into a commercial context, let's look at the data. For small ecommerce businesses, whose challenges often mirror those of the service firms and start-ups we work with, the differences can be stark.

Example CAC Benchmarks for UK Business Sectors

Comparing your numbers to sector-specific benchmarks is one of the quickest ways to gauge performance. The table below shows typical CAC ranges for several key industries in the UK, providing a starting point for your own analysis.

| Industry Sector | Typical CAC Range (£) |

|---|---|

| Retail (Ecommerce) | £20 – £150 |

| Professional Services (e.g., Legal, Accounting) | £250 – £800 |

| SaaS (Software-as-a-Service) | £300 – £1,000+ |

| Financial Services | £150 – £500 |

| Travel & Hospitality | £50 – £200 |

These figures are a guide, not a rigid rule. Your own CAC will depend on your specific business model, but this illustrates the variability of the landscape.

Data from Shopify UK, for example, highlights this variation. For small ecommerce businesses with fewer than four employees, the average CAC in arts and entertainment was just £21. At the other end of the scale, health and beauty was £127, fashion and home & garden were both around £129, and electronics topped the list at £377 per customer.

This proves that a 'high' CAC is entirely relative. A £377 cost to acquire an electronics customer is viable if they are buying a £2,000 gaming laptop. That same cost would be a disaster for a business selling £30 art prints.

For UK B2B and service-based businesses, the numbers can be even more varied, depending on the niche and average contract value. It is not unusual to see a CAC anywhere from £250 for professional services to well over £1,000 for enterprise software or specialist consulting. The guiding principle remains the same: measure the cost against the long-term value the client brings to your business.

Actionable Strategies to Reduce Your Acquisition Cost

Knowing your Customer Acquisition Cost is step one. Actively reducing that number is the strategic imperative that builds a more profitable, scalable business.

Lowering your CAC is not about blindly slashing your marketing budget. It is about making every pound work harder and more intelligently. This requires a strategic review of your entire marketing and sales funnel to identify the levers with the greatest impact. The objective is simple: improve efficiency at every stage, from initial awareness to conversion. Get this right, and you will not only cut costs but also attract higher-quality customers.

Fine-Tune Your Paid Advertising

Paid channels like Google Ads and Meta Ads are effective for reaching audiences, but they can quickly burn through cash if not managed with precision. The primary driver of high CAC from paid ads is wasted spend: paying for clicks from people who were never going to convert.

The most direct way to fix this is to implement laser-focused targeting. Stop casting a wide, expensive net and concentrate your budget on the specific demographics, interests, and behaviours that align with your ideal customer profile.

Here is where to start:

- Implement Negative Keywords: Actively prevent your ads from showing for irrelevant search terms. This is the quickest way to stop paying for clicks from users with the wrong intent.

- Utilise Audience Segmentation: Do not use a one-size-fits-all message. Create separate campaigns for different customer personas. The message that resonates with a Marketing Manager will not be the same one that engages a CFO.

- Optimise Ad Creative and Copy: Continuously test your campaigns. A/B test headlines, images, and calls to action to identify the combinations that deliver the highest engagement for the lowest cost.

By directing your budget towards a more qualified audience, you drastically reduce wasted clicks and ensure every pound is accountable for performance.

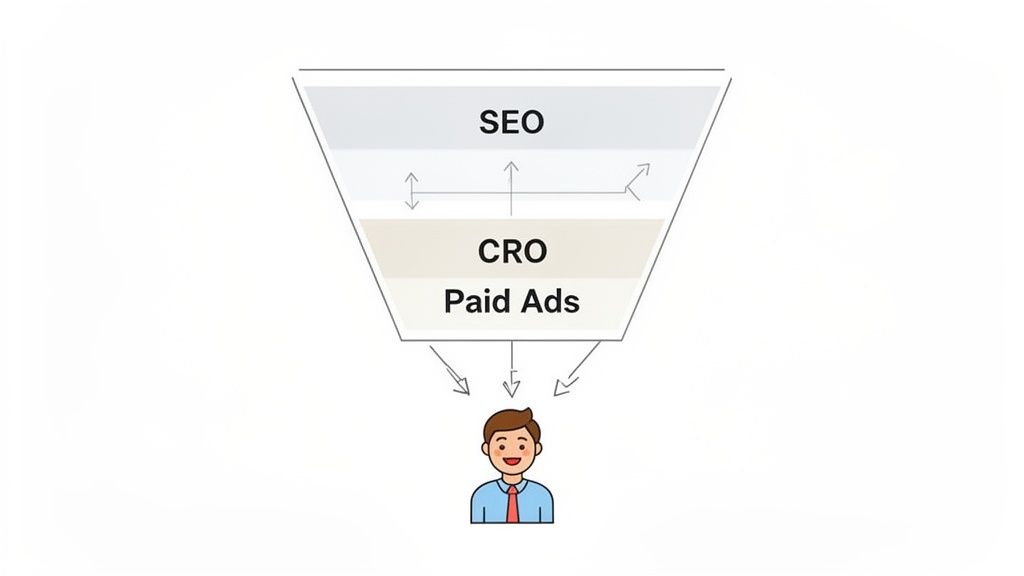

Maximise Value With Conversion Rate Optimisation

Your website is your primary sales asset. If it fails to convert visitors into leads or customers, you are wasting marketing spend and artificially inflating your CAC. This is where Conversion Rate Optimisation (CRO) becomes critical. It is the systematic process of improving your website to increase the percentage of visitors who take a desired action.

Even minor improvements in your conversion rate can have a massive impact on your acquisition cost. If you can double your website's conversion rate, you have effectively cut your CAC in half without spending another penny on advertising. For a detailed guide, see our article on Conversion Rate Optimisation best practices.

A website with a 1% conversion rate that receives 1,000 visitors will generate 10 leads. Improving that conversion rate to just 2% doubles the output to 20 leads from the exact same traffic and marketing spend.

This demonstrates that optimising existing assets is often the most cost-effective path to growth. Focus on making your value proposition crystal clear, simplifying forms, improving page load speeds, and ensuring your calls to action are prominent and compelling.

Build a Sustainable Pipeline With SEO

Paid ads generate traffic today, but Search Engine Optimisation (SEO) builds a low-cost, high-quality pipeline for the long term. Once you achieve high rankings on Google for your most important keywords, you gain a steady stream of relevant visitors without paying for every click.

SEO is a powerful marketing asset. The initial investment in content and technical optimisation continues to deliver returns for months, and even years, driving down your blended CAC over time. A robust SEO strategy turns your website into a lead generation machine that operates 24/7.

Furthermore, this approach naturally builds trust and authority. You attract prospects who are actively searching for the solutions you provide, meaning they are often more qualified and ready to convert than leads from more disruptive advertising formats.

Drive Efficiency With Marketing Automation

How much time does your team spend on manual, repetitive tasks? Every minute is a cost that contributes to your CAC. Marketing automation removes these workflows from their workload, freeing them to focus on high-value activities: strategy, creativity, and relationship building.

For example, using tools like chatbots for lead generation can automatically convert website conversations into qualified leads. By automating initial lead qualification, email follow-ups, and nurturing sequences, you ensure no opportunity is missed. This increases the productivity of your entire sales and marketing function, allowing you to achieve more with the same headcount and ultimately lowering your cost to acquire each new customer.

How a Performance Partner Drives Down Your CAC

Understanding and optimising your Customer Acquisition Cost is a vital internal function, but the fastest path to results often involves engaging specialist expertise. Working with a performance-led growth partner is a strategic decision to achieve outcomes more efficiently than you could alone.

An experienced partner brings a fresh, data-driven perspective to your entire acquisition funnel. Unburdened by historical campaign attachments or internal politics, they can identify and resolve issues with speed and precision. This external viewpoint is often what is needed to break through a performance plateau.

Strategic Oversight and Specialist Execution

A true performance partner acts as an extension of your team, providing specialist knowledge that is often difficult and expensive to build in-house. They are experts in platforms like Google Ads and Meta, staying ahead of algorithm changes and advanced strategies that unlock superior performance.

This deep expertise translates directly into a lower CAC in several key ways:

- Faster Optimisation Cycles: An agency can test, learn, and refine campaigns far more quickly than a small in-house team. They can rapidly identify the ad creative, audiences, and bidding strategies that deliver the best return on investment.

- Access to Advanced Tactics: They are equipped to deploy sophisticated retargeting campaigns, build complex audience segments, and implement advanced conversion tracking to extract maximum value from every pound spent.

- A Holistic Funnel View: A strong partner looks beyond ad clicks. They analyse the entire customer journey, from the first impression to the final sale, identifying friction points on your website or in your sales process that are secretly inflating your acquisition costs.

Accountability You Can Measure

Ultimately, a performance partner is judged on results. Their entire focus is on improving the metrics that matter to your bottom line: lead quality, cost per lead, and, most importantly, your Customer Acquisition Cost. This sharp focus ensures every action taken is designed to make your marketing spend work harder.

Working with a specialist is an investment in efficiency. You are leveraging their expertise to acquire customers at a lower cost and a faster pace, which frees up your own team to focus on business strategy and product innovation.

Data highlights the efficiency of this approach. For small businesses, agencies can often acquire customers for as little as £100-£200. Compare that to a sector like fintech, where CAC can reach £1,450, and you can see how specialist knowledge and focused execution make a significant difference. You can explore these industry acquisition cost benchmarks on wearefounders.uk for more context.

By entrusting this function to a specialist team, you are not just buying a service; you are investing in a more profitable and scalable method of business growth. To understand what this looks like in practice, it is worth learning more about what defines a true performance-based marketing agency and how they align their success directly with yours.

Got Questions About CAC? We’ve Got Answers.

When it comes to the practicalities of running a business, several common questions about Customer Acquisition Cost consistently arise. Let's address some of the most frequent queries we hear from business owners.

What Is a Good LTV to CAC Ratio?

This is a critical question. While it varies by industry, the gold standard for a healthy, growing business is a 3:1 ratio. This means for every pound you spend to acquire a customer, you generate three pounds in lifetime value.

A ratio below 1:1 indicates you are losing money on every new customer, a position which is unsustainable. Conversely, a ratio above 5:1, while seemingly positive, often suggests you are under-investing in growth and likely missing opportunities to capture a larger market share.

Should Fixed Costs Like Rent Be in My CAC Calculation?

In short, no. Your CAC calculation should only include costs directly attributable to acquiring new customers. This includes ad spend, sales and marketing salaries, agency fees, and software licences for your marketing tools.

General business overheads like rent or utilities should not be included, unless you can accurately apportion the percentage used specifically for your acquisition efforts, which can become overly complex. Stick to direct costs for clarity and accuracy.

How Often Should I Calculate My CAC?

It is good practice to track your CAC on a monthly basis. This provides a real-time pulse on campaign performance and allows you to identify any short-term issues before they escalate.

Alongside this, a quarterly review helps to smooth out any monthly fluctuations and provides a more stable picture for larger strategic decisions and budget planning.

A Quick Word of Advice

Regularly monitoring your CAC is like having an early warning system. You will detect shifts in channel performance or hidden cost increases before they can derail your budget.

Common Calculation Pitfalls

It is surprisingly easy to miscalculate CAC. Be aware of these common errors:

- Forgetting to include costs like sales commissions or referral fees.

- Using your total customer count for the period, instead of only new customers.

- Ignoring the attribution windows for your paid ad campaigns, which can skew the numbers.

Revisiting your formula and data sources regularly is crucial. It ensures the number you are analysing is a true reflection of your business performance.

Ready to reduce your CAC and improve the quality of your sales pipeline? Speak to Lead Genera today for measurable, sustainable growth.