Weekly marketing wisdom you can read in 5 minutes, for free. Add remarkable ideas and insights to your inbox, once a week, by subscribing to our newsletter.

Market Mapping Definition: A Strategic Guide for B2B Growth

Think of market mapping as creating a detailed commercial blueprint for your business landscape. It’s not just a list of potential customers; it’s a strategic overview showing you the high-value commercial districts, profitable industry clusters, and underserved niches within your total addressable market. This process transforms abstract data into a clear, actionable plan for growth.

What is Market Mapping in a Commercial Context?

Let's cut through the jargon. For a B2B business, a modern market mapping definition is about one thing: quantifying and visualising your most profitable market segments to drive predictable lead generation. It is the foundational work of identifying, segmenting, and prioritising every potential customer that fits your ideal profile.

Instead of a scattergun approach, market mapping provides the clarity to focus your sales and marketing resources where they will deliver the highest return. It moves beyond a simple list, creating a dynamic picture of your entire commercial ecosystem. This process helps you answer the critical questions that directly impact your bottom line.

Core Components of a Commercial Market Map

A robust market map is built in layers, much like a geographical survey. Each layer of data adds crucial context, helping you move from a high-level view to a precise, street-level targeting strategy.

We have broken down the key components to show how these data points build on each other, from traditional firmographics to modern, intent-driven signals.

| Key Components of a Commercial Market Map |

| :— | :— | :— |

| Data Category | Description | Example Application for Lead Generation |

| Firmographics | This is your baseline data: the essentials like company size, annual turnover, and industry sector (using UK SIC codes). | Defines the basic shape of your target businesses. For instance, filtering for UK manufacturing companies with 50-250 employees. |

| Geography | Pinpointing the physical location of your prospects is crucial for territory planning, localised campaigns, and understanding regional market density. | Planning a regional sales drive in the North West or targeting ads to businesses within the M25 corridor. |

| Digital Signals | This is where modern mapping gives you a serious competitive edge. It includes data on a company's technology stack, hiring activity, and online behaviour. | Identifying companies that have recently started using HubSpot (indicating marketing investment) or are hiring for sales roles (signalling growth). |

These components, especially when combined, create a powerful and nuanced picture of your market. In the UK, we see successful SMEs using this exact approach to define their addressable market before spending a single pound on lead generation.

From Map to Actionable Insight

Ultimately, market mapping is the bridge between market potential and commercial execution. It allows you to build a detailed Ideal Customer Profile (ICP), which is the first and most critical step in understanding how to find leads for sales and fill your pipeline.

The map provides the raw data you need to create detailed buying personas, ensuring your marketing messages resonate with the right people inside the right companies.

This is not just theory. This strategic foundation directly informs how you set your marketing budget, structure your sales team, and build targeted campaigns that deliver higher-quality leads and a much better return on ad spend.

Why Market Mapping Drives Predictable Growth

Understanding what market mapping is is one thing; using it to generate consistent revenue is another. A well-constructed map transforms your marketing from a reactive, scattergun approach into a proactive system for predictable growth.

It is the difference between guessing where your next customer will come from and having a clear blueprint to go and find them.

Without a map, budgets are spread thinly across dozens of channels and audiences, hoping something sticks. This inefficiency silently kills profitability. Market mapping forces strategic resource allocation. You stop wasting ad spend on audiences that will never convert and free up that budget to dominate the segments that will.

From Unpredictable Costs to Efficient Investment

The most significant commercial benefit is a dramatic improvement in your cost per lead (CPL). When your paid advertising and sales outreach are focused exclusively on pre-qualified, high-fit segments, every pound you spend works harder.

This disciplined approach has a direct impact on your bottom line and is a crucial first step in understanding the cost of customer acquisition at a much deeper level.

Instead of chasing vanity metrics, you start building an engine that delivers commercially viable leads. This focus delivers several key results:

- Dramatically Increased Lead Quality: You move beyond generating mere enquiries to attracting prospects who have a proven need, the right budget, and the authority to make a decision.

- Boosted Sales Team Efficiency: Your sales team receives leads that are already an excellent fit. This means less time wasted on dead-end qualification calls and more time closing deals with prospects genuinely in the market for your solution.

- Clearer Performance Measurement: With clearly defined segments, you can accurately measure which parts of your market are responding best. This allows for constant optimisation: doubling down on what works and cutting what does not.

A market map is not just a strategic document; it is a commercial tool. It provides the clarity needed to build a repeatable, scalable lead generation engine that fuels genuine business growth, turning marketing from a cost centre into a predictable revenue driver.

Ultimately, market mapping delivers the strategic clarity required to build a predictable pipeline. It aligns your marketing spend, sales activity, and overall business goals, ensuring every action is geared towards attracting and converting your most valuable customers. This is not just about better targeting; it is about building a more resilient, efficient, and profitable business.

How to Build Your First Market Map in 5 Steps

Creating a market map can sound like a complex, data-heavy project suited only for large corporations, but this is a misconception. For a B2B service business, building a practical, high-impact map is achievable with the right process and tools. This is about creating strategic clarity, not academic complexity.

This five-step framework cuts through the jargon and breaks the process down into manageable actions, giving you a clear, operational view of your market.

Step 1: Define Your Ideal Customer Profile

Before you map any landscape, you need to know what you are looking for. Your Ideal Customer Profile (ICP) is the absolute foundation of this entire process. Think of it as a precise definition of the type of company that gets the most value from your services and, just as importantly, provides the most value back to your business.

Your ICP must be more than a vague description. You need to define it with concrete, firmographic data:

- Industry: Which specific sectors do you serve best? Using UK SIC codes provides excellent precision.

- Company Size: Define this by both employee headcount and annual turnover. For example, "UK-based software companies with 50-200 employees and £5M-£25M turnover."

- Geography: Be specific. Pinpoint the regions, counties, or cities where your best-fit customers are located.

Without a sharp ICP, your map will be a fuzzy, out-of-focus picture of the entire market. With one, it becomes a high-resolution image pinpointing your most profitable opportunities.

Step 2: Gather Your Market Intelligence

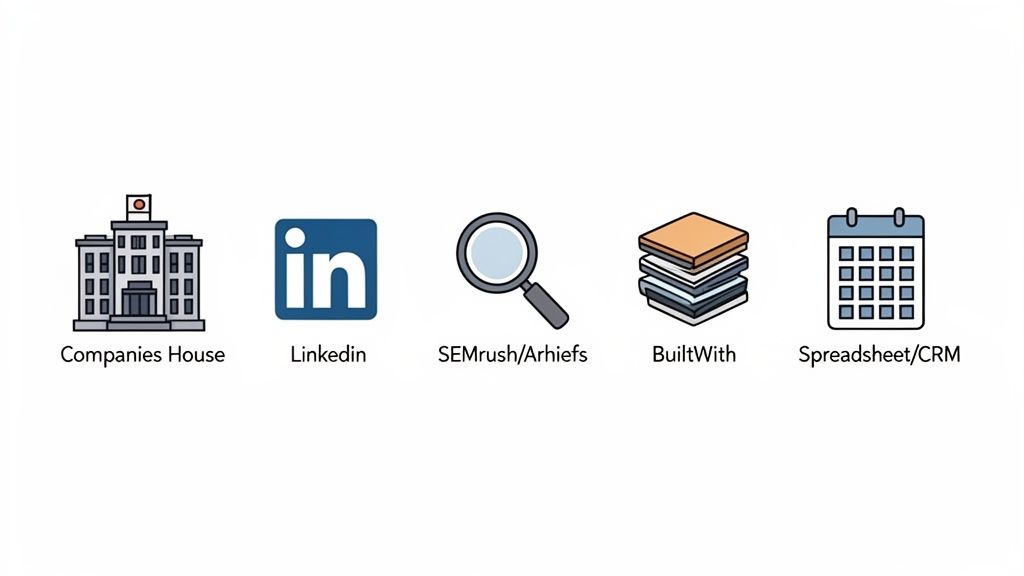

Once your ICP is defined, it is time to find the companies that match it. This intelligence-gathering phase does not require expensive enterprise software. A combination of public and professional data sources is often more than sufficient to build a powerful dataset.

Start with accessible tools. Companies House is excellent for foundational firmographic data, and LinkedIn Sales Navigator is brilliant for identifying companies and the key decision-makers within them based on your ICP criteria. These platforms are your core tools for initial data collection.

Tools like Sales Navigator allow you to apply incredibly precise filters for industry, company size, and location. In just a few clicks, you can generate a list of potential target accounts that are a perfect match for your ICP.

Step 3: Segment Your Total Addressable Market

Now you have your raw data. The next step is to segment your Total Addressable Market (TAM) into smaller, more manageable groups. Segmentation transforms a long, intimidating list of companies into a structured framework you can use for prioritisation.

You will want to group your prospects using meaningful criteria that align with your go-to-market strategy. Common segmentation methods include:

- By Industry Vertical: Grouping all your manufacturing clients together versus all your professional services firms.

- By Revenue Tier: Separating high-value enterprise targets from your mid-market or SME accounts.

- By Technology Stack: Identifying all companies that use a specific CRM (like HubSpot or Salesforce), which might signal a perfect opportunity for your integration services.

This step transforms your data from a simple list into a genuine strategic asset, revealing distinct clusters of opportunity within your market.

Step 4: Score and Prioritise Your Segments

Not all segments are created equal. Prioritisation is where you apply commercial judgement to decide where to focus your time and money for the highest return. The key is to score each segment against a consistent set of criteria.

When building your map, a deep dive into the competitive landscape is crucial; mastering effective SEO competitor analysis can reveal which segments are already crowded and which offer a clearer path to market.

Score your segments based on market size (how many companies are in it?), competitive intensity (how many rivals are already targeting them?), and strategic alignment (how closely do they match your core business goals?).

This scoring process naturally creates a clear hierarchy. Your Tier 1 segments become the immediate focus for your proactive sales and marketing campaigns, while other tiers might be earmarked for longer-term nurturing.

Step 5: Visualise and Activate the Map

Finally, it is time to bring your map to life. The goal is not a decorative chart for a presentation; it is a visual tool that your sales and marketing teams can use daily. For many businesses, a well-organised spreadsheet or a dashboard within your CRM is the most practical and effective solution.

Use colour-coding, filters, and charts to represent your different segments and tiers. This visualisation makes it simple to assign sales territories, plan highly targeted marketing campaigns, and track progress against each segment. Your map is no longer just data; it is an active, operational tool that guides your daily lead generation and drives measurable growth.

Activating Your Market Map for Lead Generation

Your market map is a strategic blueprint, not a historical document. Its real value is realised when you plug it directly into your live lead generation channels. This is where upfront strategic work pays off, translating directly into higher-quality leads, lower acquisition costs, and a more predictable sales pipeline.

Your map's segments become the building blocks for hyper-targeted audiences. Instead of launching broad, generic campaigns, you can now run precise, segment-specific initiatives that speak directly to the challenges and motivations of each customer group.

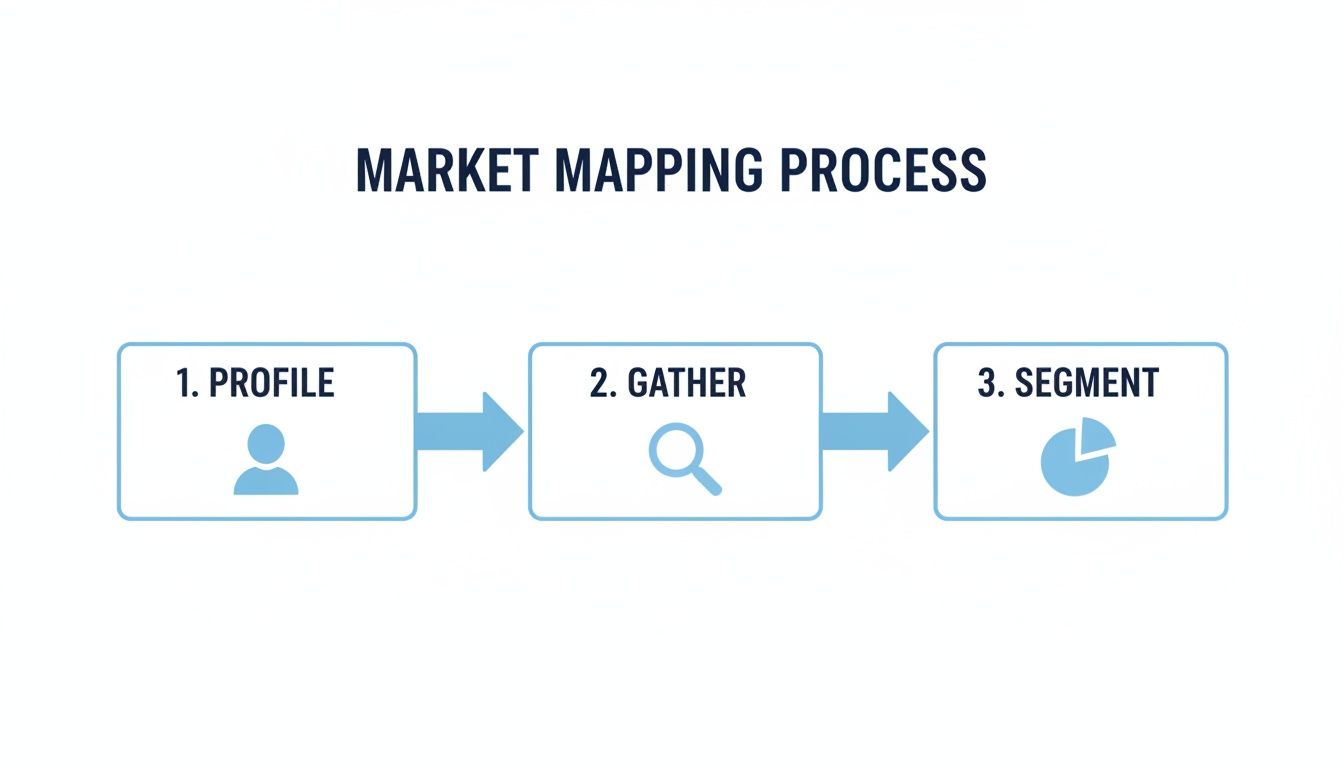

This simple diagram shows the core process of turning market intelligence into actionable segments.

The flow from profiling your ideal customer to segmenting the market is the engine that drives targeted, effective execution.

Connecting Your Map to Paid Media

For paid advertising on platforms like Google Ads and Meta Ads, your map is a game-changer. You can build custom audiences that directly mirror your highest-priority segments, which dramatically improves campaign relevance and your return on ad spend (ROAS).

Imagine you have identified a segment of UK-based logistics firms with 50-200 employees that use a specific warehouse management system. You can now build a campaign with messaging, creative, and landing pages tailored exclusively to them. This precision stops you wasting budget and focuses your investment where it will generate the best commercial return. This is a fundamental part of learning how to create a digital marketing funnel that converts.

Fuelling SEO and Outreach with Precision

Your market map also refines your SEO strategy. By understanding the specific language and pain points of your priority segments, you can target high-intent, long-tail keywords that your ideal customers are actually searching for. This shifts your SEO from a broad visibility exercise to a targeted lead generation channel.

For sales outreach, the map is even more direct. It becomes a blueprint for building high-quality, targeted prospect lists. Your sales team can stop prospecting blindly and start engaging with accounts that are pre-qualified as a strong strategic fit, boosting both their efficiency and morale.

Today, the market mapping definition for UK businesses increasingly merges with technology-driven channel planning. This strategic alignment is producing remarkable results, especially in B2B services. Companies using AI-assisted lead generation have reported a 215% increase in qualified leads at an average £32 cost per lead, showing what a well-mapped market can deliver. Discover more insights about AI lead generation on shapethemarket.com.

Ultimately, activating your map means closing the gap between strategy and execution. It ensures every pound spent and every hour invested is aimed squarely at the most valuable segments of your market, creating a direct and measurable link between your planning and your bottom line.

Common Market Mapping Mistakes to Avoid

A market map is a powerful commercial tool, but its value depends entirely on how it is built and used. Even with the best intentions, several common mistakes can render your map useless, leading to wasted time and poor commercial decisions. Getting this right means avoiding the pitfalls to create a tool that genuinely drives growth.

Many businesses fall into the trap of building a map that is either too academic or based on flimsy, outdated information. The goal is not to create a complex theoretical model; it is to build an actionable blueprint for your sales and marketing teams. A map that is too complicated to use is just as ineffective as one built on bad data.

Relying on Stale or Incomplete Data

This is the single biggest mistake. Building your map with outdated or incomplete information is the most common failure. A list of companies from a database purchased six months ago is not a market map; it is a historical record. Markets move fast: companies change, people switch jobs, and priorities shift. Basing your strategy on old data means you will be targeting the wrong people and wasting outreach efforts.

The solution is to treat your data as a living asset. Your map requires regular refreshes, pulling in real-time signals like new hiring activity, recent funding announcements, or shifts in a company's technology stack. This is the only way to ensure you are always targeting the market as it is right now, not as it was last quarter.

Confusing Market Size with Profitability

Another classic error is assuming a large market segment automatically equals a profitable one. It is easy to get excited by a list containing thousands of potential companies, but size is not the same as opportunity. A huge, crowded market can be an incredibly expensive place to acquire customers, often leading to a poor return on investment.

The best market maps prioritise profitability over sheer volume. You will almost always get a better return from a smaller, well-defined niche where you have a clear competitive advantage than from a broad, saturated market.

Instead, focus your analysis on finding the sweet spots: the segments where your value proposition resonates most strongly and where you can win business without a protracted fight. That strategic focus is what turns a market map from a simple chart into a profit-generating tool.

Treating the Map as a One-Time Project

Finally, many organisations create a market map, tick the box, and file it away. This completely misses the point. Your market map should be a living document that evolves alongside your business and the market itself. Think of it as a strategic guidance system, not a static report to be reviewed annually.

Make the map a core part of your regular sales and marketing planning. Use it to evaluate campaign performance, spot emerging trends, and adjust your priorities. By treating it as an active, operational tool, you ensure it remains relevant and continues to be a powerful guide for predictable growth.

Essential Tools for Effective Market Mapping

A robust market map is only as good as the data it is built on. The good news is you do not need an enterprise-level budget to get the required insights. A smart combination of accessible tools can provide a detailed view of your market, allowing you to build a map that genuinely drives sales.

The right tech stack allows you to see beyond the basics and start identifying the digital signals that indicate a company is actively looking to buy. This is critical now that so much business is conducted online. With UK ecommerce projected to hit £285.6 billion by 2025, understanding your prospects' digital behaviour is not just a nice-to-have; it is essential for growth. You can find out more about these UK ecommerce trends from Netguru.

Company and Firmographic Databases

This is your starting point. These platforms help you identify the companies that fit your Ideal Customer Profile by providing foundational data on their size, location, and industry.

- Companies House: The official UK register is a brilliant, free resource. It provides fundamental data for every limited company, perfect for initial validation that a business is legitimate and fits your basic criteria.

- LinkedIn Sales Navigator: An indispensable tool for filtering companies by size, sector, and location. It also helps you pinpoint the key decision-makers within those organisations.

- Beauhurst: A powerful, UK-focused platform that tracks high-growth companies. It is fantastic for spotting trigger events like funding rounds that signal a company is ready to invest and grow.

Digital Demand and Intent Tools

These tools help you understand what your target market is searching for online. They uncover digital demand and show you how competitive certain areas are, which is vital for aligning your map with your SEO and paid advertising strategies.

- SEMrush & Ahrefs: Both are excellent for understanding search volumes, keyword difficulty, and competitor activity. They effectively help you quantify the digital opportunity within your target segments.

The real commercial advantage comes from combining firmographic certainty with digital intent. Knowing a company fits your profile is good. Knowing they are actively searching for the solutions you provide is what drives high-quality lead generation.

Technographic and Organisational Tools

Technographic data tells you what technology a company is already using, which can be a powerful qualifying signal. And of course, you need a way to bring all this intelligence together into a usable format.

- BuiltWith: This tool is excellent for identifying the technology stacks of websites. It allows you to target companies that use specific CRMs, marketing platforms, or ecommerce software that may be compatible with your own services.

- CRM & Spreadsheets: Whether it is a dedicated platform like HubSpot or Salesforce, or even just a well-organised Google Sheet, you need a central place to organise, segment, and visualise your final map.

Frequently Asked Questions About Market Mapping

To conclude, let's address some of the common questions we hear from business owners and marketing directors about the practical side of market mapping. These are direct, consultant-led answers to help you start with confidence.

How Often Should I Update My Market Map?

It is best to treat your market map as a living document, not a static report. We recommend a full, in-depth review at least annually. You should also revisit it whenever there is a significant shift in your strategy, such as launching a new service or expanding into a new region.

However, the data within the map requires more frequent attention. A quarterly check-in is ideal for refreshing firmographic data, adding new companies to your target list, and removing any that are no longer a good fit. This regular maintenance keeps your map accurate and your targeting effective.

Market Mapping vs Market Segmentation: What is the Difference?

This is a very common point of confusion, but the distinction is simple. Think of it this way: market segmentation is one of the most important actions you take during the broader process of market mapping.

- Market Mapping is the entire strategic exercise. It is the process of defining, measuring, and visualising your total potential market.

- Market Segmentation is the specific step where you divide that large market into smaller, more manageable groups based on shared characteristics like industry, company size, or specific needs.

In short, segmentation brings order to the data. It turns a large, overwhelming list of potential customers into a clear, prioritised framework that your sales and marketing teams can use effectively.

Can a Small Business Do This on a Limited Budget?

Absolutely. Effective market mapping is driven by strategic thinking, not expensive software. A small or medium-sized business can build a powerful 'minimum viable map' using tools that are either free or very low-cost.

A combination of public data from sources like Companies House, a well-utilised LinkedIn Sales Navigator subscription, and an organised spreadsheet is all you need to get started. The real investment is not in software licences; it is in the time and focus dedicated to defining your ideal customer and segmenting the market with discipline.

A clear market map is the foundation for predictable growth, but activating it requires expertise. At Lead Genera, we build and execute data-driven lead generation strategies that turn market intelligence into a consistent sales pipeline.

Discover how our strategic approach can fuel your growth at leadgenera.com