Weekly marketing wisdom you can read in 5 minutes, for free. Add remarkable ideas and insights to your inbox, once a week, by subscribing to our newsletter.

Cost per acquisition: A Practical Guide to Lowering CPA for UK Businesses

Cost per acquisition, or CPA, is the total price your business pays to acquire a new customer through a specific marketing campaign or channel.

Think of it less as another metric on a dashboard, and more as the true commercial cost of growth. It is the ultimate test of your marketing’s viability.

Table of contents:

Why Cost Per Acquisition Is Your Most Important Metric

Imagine your marketing and sales operation as a factory. The investment in advertising, content, and agency fees is the raw material. The finished product is a new, paying customer.

Your cost per acquisition is the total cost to produce one of those customers. It reveals the real efficiency of your growth engine.

For any business owner or marketing director focused on profitable growth, this figure is non-negotiable. Without a firm grip on your CPA, you are operating blind. You cannot answer the most critical commercial questions: Are my campaigns generating profit? Which channels are genuinely profitable? Where should I invest my next pound for the greatest impact?

Clarifying Key Acquisition Metrics

CPA is often confused with similar terms, but the differences are commercially significant. Each metric tells a different part of your growth story, and using the right one helps you avoid costly strategic errors.

- Cost Per Lead (CPL): This measures how much it costs to generate an interested prospect, not a paying customer. It is a top-of-funnel metric, useful for judging the efficiency of campaigns capturing initial interest.

- Cost Per Acquisition (CPA): This measures the cost to secure a specific conversion, almost always the final sale. As a bottom-of-funnel metric, it is directly tied to revenue and confirms whether a campaign is commercially successful.

- Customer Acquisition Cost (CAC): This is the broadest metric. CAC includes your total sales and marketing spend—salaries, software, overheads—and divides it by the number of new customers acquired. We have a detailed guide that breaks down understanding the cost of customer acquisition.

These metrics track the journey from initial interest to final sale. The following table provides a side-by-side comparison.

Key Acquisition Metrics at a Glance

| Metric | What It Measures | When to Use It |

|---|---|---|

| Cost Per Lead (CPL) | The cost to obtain a potential customer’s contact details. | To assess the performance of top-of-funnel campaigns (e.g., content downloads, webinar registrations). |

| Cost Per Acquisition (CPA) | The cost to convert a lead into a paying customer. | To evaluate the profitability and effectiveness of specific marketing campaigns or channels. |

| Customer Acquisition Cost (CAC) | The total sales and marketing cost to acquire one new customer. | For high-level financial planning, assessing overall business model viability, and investor reporting. |

Using these definitions correctly is essential for making smart, profitable decisions.

Your CPL tells you the cost of a conversation; your CPA tells you the cost of a customer. One measures interest, the other measures profit. Focusing on the latter separates vanity metrics from viable business strategy.

The Rising Cost of Acquiring Customers

Tracking CPA has become more critical than ever. In the UK, the cost to acquire a customer has climbed sharply as the digital advertising market has become more competitive.

Between 2019 and 2024, UK digital ad spend increased from approximately £15.6 billion to over £27 billion. This influx of advertisers into the same ad auctions has driven up costs. To learn more about the fundamental definition and significance of this metric, explore this guide on What Is Cost Per Acquisition and Why It’s Your Most Important Metric.

With this level of competition, a precise understanding of your CPA is not just good practice, it is essential for survival and growth.

How to Calculate Your True Cost Per Acquisition

A vague estimate of your cost per acquisition is a dangerous basis for decision-making. To gain proper control over your marketing performance, you need precision. The basic CPA formula appears simple, but accurately defining the inputs is where most businesses make mistakes.

The core calculation is:

CPA = Total Marketing Spend / Total New Customers Acquired

If you spend £5,000 on a Google Ads campaign and it generates 50 new customers, your CPA is £100. The problem is, ‘Total Marketing Spend’ is rarely just your ad budget.

Defining Your Total Marketing Spend

To calculate a CPA that reflects reality, you must look beyond the obvious. A true calculation includes all associated costs required to land that customer. Failure to do so results in a deceptively low CPA that can lead to flawed budget decisions.

Your real total spend should include:

- Direct Ad Spend: The money paid directly to platforms like Google, Meta, or LinkedIn.

- Agency Fees: If you work with a performance marketing partner, their retainer or management fees must be included.

- Software & Tools: The cost of your landing page builder, analytics platform, or creative software.

- Internal Team Costs: A portion of the salaries for in-house staff who manage or support these campaigns.

This comprehensive approach ensures your CPA is a genuine reflection of the cost to the business, providing a solid foundation for strategy.

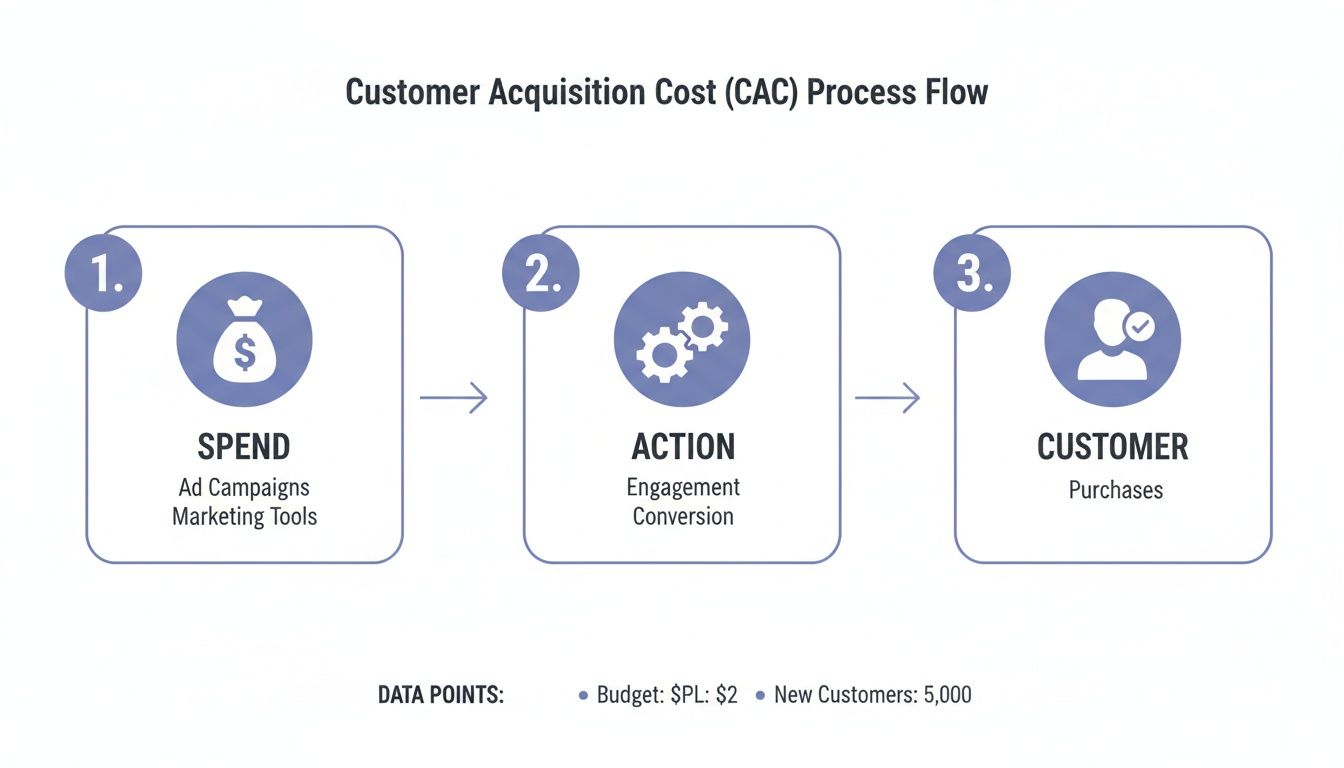

This flowchart breaks down the simple three-step journey, from initial investment to customer acquisition.

It is a useful visual reminder of how total spend fuels the actions that produce a new customer.

Choosing the Right Attribution Model

Another critical component is deciding how to credit a conversion. A customer rarely sees one ad and buys immediately. They often interact with your brand across several channels before committing. Your chosen attribution model will directly impact your calculated CPA for each of those channels.

- First-Touch Attribution: This model gives 100% of the credit to the first marketing touchpoint. It is useful for identifying which channels initiate the customer journey.

- Last-Touch Attribution: This gives all the credit to the final interaction before the sale. It is excellent for identifying which channels are your most effective ‘closers’.

- Multi-Touch Attribution: Models like linear or time-decay distribute credit across multiple touchpoints, providing a more nuanced view of the entire journey. However, they can be more complex to set up and analyse.

For most businesses starting out, a last-touch model is the most practical choice. It is clear, easy to track, and directly links spend to a sale, which is perfect for demonstrating ROI. As your marketing matures, you can explore multi-touch models for deeper insights into how channels work together.

A Worked Example for a UK Service Business

Let’s apply this to a real scenario. Imagine a UK-based accountancy firm running a Google Ads campaign to generate new client sign-ups.

Their costs for one month:

- Google Ads Spend: £3,000

- Agency Management Fee: £750

- Landing Page Software: £50

Total Marketing Spend = £3,800

During that month, the campaign generated 19 new clients.

Their CPA calculation is:

£3,800 / 19 = £200 per new client

With an accurate £200 CPA, the firm can make informed decisions. If the average new client is worth £2,500 in the first year, a £200 acquisition cost is excellent. If they had only counted ad spend, their CPA would appear to be just £158, providing a dangerously skewed view of marketing efficiency.

What a Good Cost Per Acquisition Looks Like in the UK

The first question every business owner asks is: “What should my cost per acquisition be?” The only honest answer is that it depends entirely on your business. A ‘good’ CPA is not a universal figure; it is a number tied to your industry, profit margins, and long-term customer value.

A CPA of £500 could be disastrous for an e-commerce business selling £75 products. But for a B2B software company whose average client is worth £30,000, that same £500 would be an exceptional investment. Context is everything.

The Link Between CPA and Customer Lifetime Value

Instead of chasing an arbitrary number, the most effective way to evaluate your CPA is by comparing it to your Customer Lifetime Value (LTV). LTV is the total gross profit you expect to make from a single customer throughout their entire relationship with your business.

This perspective changes the entire dynamic. Acquisition is no longer just a cost to be minimised, but a strategic investment that must deliver a profitable return over time. The metric that truly matters is the LTV to CPA ratio (often referred to as the LTV:CAC ratio).

A healthy business model demands that your LTV is significantly higher than your CPA. If you spend £200 to acquire a customer who generates only £150 of profit, your growth engine is operating at a loss.

Establishing Your LTV to CPA Ratio

For UK B2B companies, particularly in services and SaaS where sales cycles can last 3 to 12 months, this ratio is the foundation of sustainable growth. A widely accepted benchmark is to aim for an LTV:CAC ratio of at least 3:1. For every £1 spent to acquire a customer, you should generate at least £3 in gross profit over their lifetime. You can find out more about how marketing leaders use customer acquisition cost benchmarks to drive growth on GenesysGrowth.com.

Consider a real-world example. A UK IT support provider acquires a new client for a CPA of £900. If that client remains for four years, generating £350 in gross profit each month, their total LTV is £16,800. This results in an LTV:CAC ratio of approximately 18.7:1, a clear signal they are well above the 3:1 benchmark and could confidently invest more into their acquisition channels.

Indicative UK CPA Benchmarks by Channel and Industry

While your LTV ratio is the ultimate measure of success, industry and channel benchmarks provide useful context. These figures can indicate whether your performance is reasonable or if there are significant opportunities for improvement.

The table below provides indicative CPA ranges for common UK business models and marketing channels. Use these as a strategic guide to inform your budget and expectations, not as rigid targets.

| Industry / Channel | Typical CPA Range (GBP) | Key Considerations |

|---|---|---|

| B2B Professional Services (e.g., Google Ads) | £150 – £400+ | Highly dependent on service value. Higher CPA is acceptable for high-value legal or financial services. |

| B2B SaaS (e.g., LinkedIn Ads) | £200 – £500+ | Long sales cycles and high LTV justify a higher initial acquisition cost. Focus is on demo requests or trial sign-ups. |

| High-Value E-commerce (e.g., Meta Ads) | £50 – £250+ | CPA must be evaluated against Average Order Value (AOV) and repeat purchase rates to ensure profitability. |

| Local Services (e.g., SEO / Organic Search) | £40 – £150 | Lower intent can mean a lower CPA, but lead quality and conversion rates are critical for commercial success. |

Ultimately, a good cost per acquisition is one that fuels profitable growth. By grounding your strategy in your LTV:CPA ratio and using these benchmarks for context, you can move from guesswork to data-driven decisions that build a more resilient, scalable business.

Tracking Your CPA Across Digital Channels

To manage your CPA effectively, you need trustworthy data. Without it, you are simply guessing where to allocate your budget. Implementing proper tracking is not just a technical task; it is a commercial necessity that enables confident investment.

The goal is to draw a direct line from an ad click to a new paying customer. This requires setting up your ad platforms and analytics to measure the actions that directly impact your bottom line.

Configuring Your Core Tracking Platforms

Most UK businesses rely on a few key platforms to drive sales and measure performance. The first critical step is ensuring each one is configured to track conversions accurately. These tools are designed to integrate, providing a complete picture of your acquisition costs.

For most, the primary measurement stack includes:

- Google Analytics 4 (GA4): This is your central hub for website activity. You must configure GA4 to track your most important conversion events, whether that is a form submission, a quote request, or a completed sale.

- Google Ads: Your Google Ads account requires its own conversion tracking to be enabled. This does more than report numbers; it feeds the platform’s algorithm with the data it needs to find more customers, not just more clicks. Over time, this helps to lower your CPA.

- Meta Ads Manager: It is essential to have the Meta Pixel installed correctly on your website. This code monitors the behaviour of users arriving from Facebook and Instagram, allowing you to trace new customers back to the specific campaign or ad that brought them in.

The key is to define your “conversions” based on genuine commercial intent. A “contact us” form submission is a start, but a “demo booked” or “checkout complete” is a much stronger signal of a real acquisition. This distinction is crucial for an honest CPA calculation.

For a deeper look at the technical aspects, our guide on why conversion tracking is important for lead generation campaigns explains how to implement it correctly.

From Leads to Customers: The Closed-Loop System

Tracking a form submission is only half the story. Your true cost per acquisition is based on paying customers, not prospects. To get that number, you need to connect your marketing data with your sales data in a process known as closed-loop reporting.

In practice, this usually involves linking your Customer Relationship Management (CRM) system to your advertising platforms. This allows you to send sales information back to Google and Meta, informing them which leads and clicks actually generated revenue.

This closed-loop feedback is the difference between basic campaign management and strategic performance marketing. It teaches the ad platforms what a high-quality lead looks like, enabling them to automatically find more people like your best customers.

This screenshot from a Google Analytics 4 dashboard shows how different channels contribute to new user acquisition.

You can clearly see the volume of new users from Direct traffic, Organic Search, and Paid Search. This is the starting point for calculating a specific CPA for each channel.

Using UTM Parameters for Granular Insight

Finally, for any marketing activity outside of major ad ecosystems, such as email campaigns, organic social posts, or affiliate promotions, UTM parameters are essential. These are simple tags added to a URL that tell Google Analytics precisely where a visitor originated.

A properly structured UTM link can identify the:

- Source: The platform that sent the traffic (e.g.,

linkedin). - Medium: The type of marketing (e.g.,

social). - Campaign: The specific promotion it was linked to (e.g.,

q4_promo).

This level of detail moves you beyond broad channel CPAs and allows you to calculate the cost per acquisition for individual campaigns. It provides the granular data needed to scale what works and cut what does not, systematically lowering your overall CPA.

Proven Strategies to Lower Your Cost Per Acquisition

Knowing your CPA is the first step. The real value is created in actively managing and reducing it. A high CPA should not be seen as a fixed cost, but as a variable that can be systematically improved with the right strategic levers.

This is not about slashing budgets or chasing cheap leads that fail to convert. It is about maximising the efficiency of every pound spent, eliminating waste, and optimising the entire customer journey from first click to final sale. The following strategies are practical, commercially-grounded approaches to boost efficiency and drive more revenue from your existing budget.

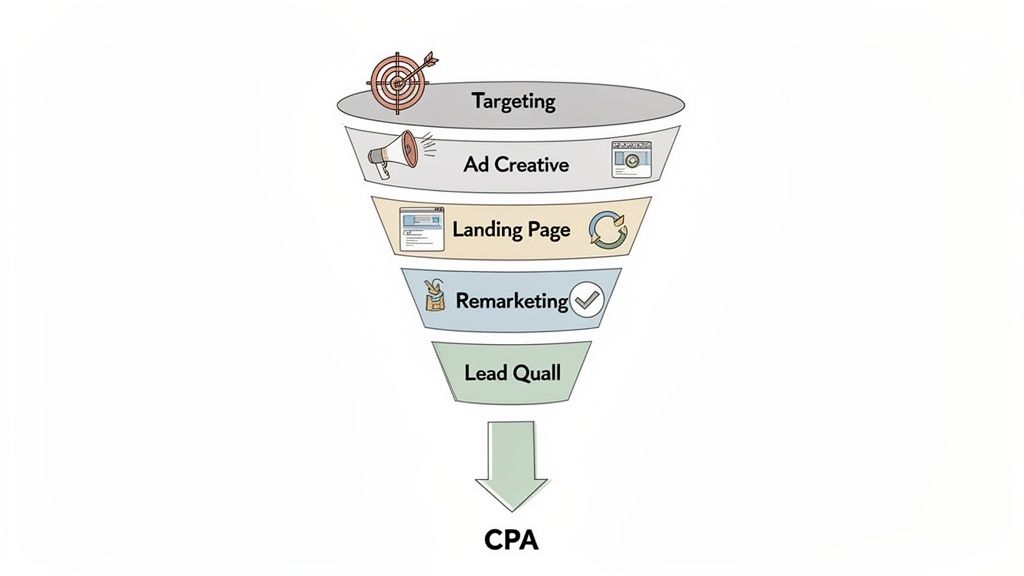

Refine Audience Targeting to Eliminate Waste

The fastest way to lower your CPA is to stop showing ads to the wrong people. Wasted ad spend on irrelevant audiences is the biggest drain on most marketing budgets. Precision targeting ensures your message reaches prospects who are genuinely in the market for your services.

Start by building a detailed ideal customer profile (ICP). Go beyond basic demographics and into specific job titles, industry challenges, and online behaviours. Use this ICP to tighten your targeting settings on platforms like Google Ads and LinkedIn.

Effective targeting involves a few key actions:

- Negative Keywords: In paid search, actively add keywords for searches you do not want to appear for. This prevents you from paying for clicks from users with the wrong intent.

- Exclusion Audiences: On social platforms, exclude existing customers, competitors, and job seekers from your campaigns. This focuses your budget purely on net-new acquisitions.

- Lookalike Audiences: Use data from your best existing customers to build lookalike audiences. Platforms like Meta are highly effective at finding new users with similar characteristics, which dramatically improves ad relevance.

Enhance Ad Creative and Messaging

Once your targeting is precise, your ad creative must perform. Generic, uninspired ads are ignored, forcing you to pay more for every click and conversion. Your creative must capture attention, resonate with your audience’s core problems, and provide a compelling reason to act.

A/B testing is essential. Continuously test different headlines, images, and calls-to-action to identify what connects with your audience. For example, does a direct, benefit-led headline outperform one that asks a question? Small changes can lead to significant uplifts in click-through rates, which in turn lowers your cost per click and, ultimately, your CPA. Implementing robust PPC advertising strategies that actually scale is fundamental to getting this right.

Optimise Landing Pages for Conversion (CRO)

Driving traffic to a landing page that fails to convert is a complete waste of investment. Conversion Rate Optimisation (CRO) is the discipline of turning more visitors into customers. Even a small improvement in your landing page conversion rate can have a significant impact on your CPA.

A campaign with a £100 Cost Per Lead and a 10% lead-to-customer conversion rate has a CPA of £1,000. Doubling your landing page’s conversion rate halves your CPL to £50. Your CPA plummets to £500, without spending a single extra pound on ads.

Focus on creating a frictionless user experience. Ensure your page loads quickly, the value proposition is immediately clear, and the call-to-action is prominent. Remove unnecessary form fields, add social proof like testimonials or client logos, and ensure the page message perfectly matches the ad’s promise.

Implement Strategic Remarketing Funnels

Few people are ready to buy on their first visit. A strategic remarketing funnel keeps you in front of interested prospects, nurturing them towards a decision at a much lower cost than acquiring a cold lead. By showing tailored ads to users who have already visited your site, you engage a warm audience that is significantly more likely to convert.

Segment your remarketing lists based on user behaviour. For example, someone who abandoned a shopping cart should see a different ad from someone who only read a blog post. This relevance makes your ads more effective and keeps your CPA low for these crucial later touchpoints. You can discover more in our complete guide to PPC management, which covers funnels in more detail.

Improve Your Lead Qualification and Sales Process

Finally, remember that CPA is about acquiring customers, not just leads. An inefficient sales process will inflate your true cost per acquisition because you are paying for leads that never generate revenue. Work closely with your sales team to establish a clear, efficient process for following up on and qualifying marketing-generated leads.

This alignment creates an invaluable feedback loop. The sales team can provide real-world insights on which channels deliver the highest-quality leads. This allows you to reallocate budget towards the sources that generate the most revenue, further optimising your overall CPA.

Making CPA a Core Part of Your Growth Strategy

Managing your cost per acquisition is not a one-off project; it is a continuous discipline of testing, measuring, and optimising that should be at the heart of your commercial planning. When executed correctly, marketing ceases to be a cost centre and becomes a predictable, data-driven engine for profitable growth.

When CPA is your guiding metric, it provides the clarity to ignore vanity metrics and make decisions grounded in commercial reality. Every pound invested should have a clear, measurable path to acquiring a new customer at a cost that makes financial sense.

Your Strategic Framework for CPA Management

The lessons in this guide can be distilled into a simple, repeatable framework for managing CPA. This structure provides control over your marketing spend and allows for systematic performance improvement.

It comes down to five essential steps:

- Define: Establish clear definitions. Differentiate between CPA, CPL, and CAC to ensure you are always measuring the right thing for the right reason.

- Calculate: Determine your true CPA. Include all associated costs, from ad spend to agency fees, to get a realistic view of performance.

- Benchmark: Contextualise your CPA. The most important comparison is against your Customer Lifetime Value (LTV). Aim for a healthy LTV:CPA ratio of at least 3:1.

- Track: Implement robust conversion tracking across all digital channels. Without reliable data, you are operating blind.

- Reduce: Systematically apply proven strategies to lower your CPA without compromising lead quality. This involves refining audiences, optimising landing pages, and improving ad creative.

Adopting this discipline is the difference between reactive budget cuts and proactive performance management. It builds a marketing function that is directly accountable for revenue and provides a clear, defensible answer to the question, “Is our marketing working?”

Ultimately, this is about strategic ownership. When you master your cost per acquisition, you are no longer just spending on marketing. You are investing in a scalable system that generates predictable returns and fuels sustainable, long-term growth.

Your Top CPA Questions Answered

Even with a solid strategy, practical questions about cost per acquisition often arise. Here are answers to some of the most common challenges businesses face.

How Does CPA Relate to ROAS?

Return on Ad Spend (ROAS) and CPA are two sides of the same coin. Both are crucial for measuring marketing efficiency but from different perspectives.

- CPA measures the cost of a specific result, such as paying £150 to acquire a new customer. It is an efficiency metric focused on inputs.

- ROAS measures the revenue generated for every pound spent on advertising, for instance, earning £5 in revenue for every £1 spent. It is a profitability metric focused on outputs.

A low CPA often leads to a high ROAS, but not always. A low CPA for a low-value product might result in a poor ROAS. Conversely, a high CPA to acquire a high-value client could deliver an excellent ROAS. To get the full picture, you must monitor both.

Is a High CPA Always a Bad Thing?

No. A high cost per acquisition is only “bad” if it is unprofitable. Context is critical, and the most important context is your Customer Lifetime Value (LTV).

If you spend £800 to acquire a new B2B client who will generate £25,000 in gross profit over five years, that is an outstanding investment. But spending £80 to acquire an e-commerce customer who makes a single £60 purchase is a recipe for failure.

Sometimes, a high CPA is a strategic necessity to attract high-value, long-term customers.

What’s the Best Way to Track CPA with a Long B2B Sales Cycle?

Tracking CPA is more complex when a sale takes months to close, but it is achievable with the right setup. The key is to connect your marketing data with your sales outcomes.

This requires a closed-loop system where your CRM communicates directly with your advertising platforms. By feeding sales data back into platforms like Google Ads or Meta, you can accurately attribute a final sale to the marketing campaigns that initiated the journey months earlier.

This setup allows you to:

- Calculate a true, revenue-driven CPA, even with a significant time lag.

- Optimise campaigns based on lead quality, not just the initial cost per lead (CPL).

- Provide ad platforms with the data needed to find more prospects who resemble your best customers.

This elevates your marketing from lead generation to a function fully accountable for driving revenue.

Ready to stop guessing and start building a predictable, data-driven acquisition engine? At Lead Genera, we specialise in creating and executing strategies that lower your cost per acquisition while increasing lead quality. Book a call with our team today to discuss how we can fuel your growth.